Lithium battery cost is a critical topic for industries ranging from consumer electronics to renewable energy. While prices have dropped significantly over the past decade, understanding what drives these costs remains complex. This article explores the economic, technological, and geopolitical factors shaping lithium battery pricing, offering insights into why costs fluctuate and what the future holds.

Part 1. What are the key raw materials affecting lithium battery cost?

The cost of raw materials accounts for 40–60% of a lithium battery’s total price. Here’s a breakdown of the most impactful components:

- Lithium: Extracted from brine or hard rock, lithium prices are volatile. For example, lithium carbonate prices surged by over 400% in 2022 due to EV demand.

- Cobalt: Used in high-energy-density batteries, cobalt’s scarcity and ethical mining concerns keep costs high. The Democratic Republic of Congo supplies 70% of global cobalt, creating geopolitical risks.

- Nickel: High-grade nickel (used in NMC batteries) is pricier but boosts energy storage. Indonesia’s recent nickel export bans disrupted supply chains, raising costs.

- Graphite: Natural graphite is cheaper, but synthetic graphite (used for faster charging) adds 10–15% to anode costs.

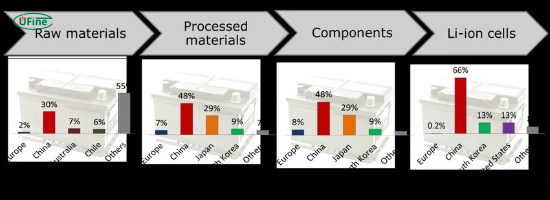

Supply chain bottlenecks, like China’s dominance in refining (80% of global lithium processing), further inflate material costs for non-Chinese manufacturers.

Part 2. How does manufacturing scale impact lithium battery prices?

Mass production is a game-changer. Large manufacturers achieve economies of scale by:

- Bulk purchasing: Companies like CATL secure lithium at 15–20% lower prices by signing long-term mining contracts.

- Automation: Tesla’s Gigafactories use AI-driven assembly lines, reducing labor costs by 30% compared to traditional methods.

- Waste reduction: Advanced manufacturing cuts material waste from 20% to under 5%, saving millions annually.

Smaller producers struggle with higher per-unit costs, so niche applications (e.g., medical devices) often pay 2–3x more for batteries than EV makers.

Part 3. Why does battery chemistry influence cost?

Battery chemistry determines both performance and cost. Popular configurations include:

LFP (Lithium Iron Phosphate):

- Pros: No cobalt, 20% cheaper, longer lifespan.

- Cons: 15–20% lower energy density.

- Use case: Tesla’s standard-range vehicles and grid storage.

NMC (Nickel Manganese Cobalt):

- Pros: Higher energy density for longer EV ranges.

- Cons: Cobalt reliance raises costs and ethical concerns.

- Use case: Premium EVs like BMW’s i-series.

Solid-state batteries:

- Pros: Double energy density, non-flammable.

- Cons: Current production costs are 8–10x higher than conventional batteries.

Emerging chemistries, like sodium-ion, could disrupt the market by eliminating lithium dependency, but they’re still in the early R&D stages.

Part 4. How do research and development expenses affect pricing?

R&D costs are amortized into battery prices, especially for cutting-edge tech:

- Battery lifespan: Extending cycle life from 1,000 to 4,000 charges requires costly nano-coating technologies.

- Fast charging: Developing 15-minute charging systems (e.g., StoreDot’s silicon-dominant cells) demands years of testing.

- Safety innovations: Solid electrolytes and thermal management systems add 5–10% to production costs.

While startups often price products higher to recoup R&D, giants like Panasonic leverage existing patents to keep costs competitive.

Part 5. What role does government policy play in lithium battery pricing?

Government interventions reshape pricing dynamics:

- Subsidies: The U.S. Inflation Reduction Act offers $35/kWh tax credits for domestically produced batteries, effectively lowering consumer costs.

- Trade policies: The EU’s proposed “battery passports” (tracking carbon footprints) could raise compliance costs by 8–12%.

- Mining regulations: Chile’s nationalization of lithium reserves may restrict supply, pushing global prices upward.

Countries are also stockpiling critical minerals, with China’s strategic reserves holding 6x more lithium than the U.S.

Part 6. How do supply chain disruptions impact costs?

Global supply chains are vulnerable to shocks:

- COVID-19: Factory closures in China (2020–2022) delayed battery shipments, causing a 25% price spike for European EV makers.

- Logistics: Shipping a container from Shanghai to Los Angeles costs $20,000 in 2021 (vs. $1,500 pre-pandemic), inflating battery costs by 5–7%.

- Energy prices: Europe’s natural gas crisis raised electricity costs for battery plants, adding $3–5/kWh to production.

Companies are adopting “nearshoring” strategies—like Ford’s $3.5B Michigan battery plant—to mitigate these risks.

Part 7. Why is energy density a cost factor?

Higher energy density reduces costs per kWh but requires advanced tech:

- Silicon anodes: Replace graphite to store 10x more lithium, but silicon swells, requiring expensive nanostructuring.

- Cobalt-free cathodes: Tesla’s 4680 cells use nickel-rich cathodes, improving density while cutting cobalt costs by 50%.

- Cell-to-pack designs: Eliminate bulky modules, boosting density by 20% but requiring precise thermal management.

A 10% increase in energy density can lower battery costs by $15–20/kWh, making R&D investments worthwhile.

Part 8. How does competition between battery manufacturers affect prices?

Market competition drives aggressive pricing:

- China: CATL and BYD dominate with low-cost LFP batteries, priced 25% below Western equivalents.

- South Korea: LG Energy Solution and Samsung SDI focus on high-density NMC batteries for luxury EVs.

- Startups: Northvolt and QuantumScape aim to undercut incumbents with sustainable or solid-state tech.

Price wars are intensifying—CATL recently offered Tesla batteries at $100/kWh, nearing the industry’s “holy grail” of $80/kWh.

Part 9. Can recycling lower lithium battery costs in the future?

Battery recycling could cut material costs by 30% by 2030:

- Direct recycling: Recover cathode materials intact, saving 40% energy vs. mining.

- Urban mining: Redwood Materials extracts 95% of nickel and lithium from scrap batteries.

- Regulatory push: The EU mandates 70% battery recycling rates by 2030, forcing companies to invest in recycling tech.

However, recycling infrastructure is still nascent. Due to high costs and technical hurdles, only 5% of lithium batteries are recycled today.

Part 10. How do geopolitical factors influence lithium battery pricing?

Geopolitics create pricing uncertainty:

- China’s dominance: Controls 60% of lithium refining and 80% of cobalt processing. U.S. tariffs on Chinese batteries raise prices for American automakers.

- Resource nationalism: Mexico nationalized lithium reserves in 2023, potentially limiting foreign access.

- Trade alliances: The U.S.-led Mineral Security Partnership aims to secure non-Chinese supply chains, but developing mines takes 7–10 years.

These tensions explain why lithium battery costs vary by region—U.S.-made batteries are 8–12% costlier than Chinese equivalents.

Part 11. FAQs about lithium battery cost

What is the most significant factor driving lithium battery costs?

Raw material prices, particularly lithium and cobalt, dominate. Lithium’s price swings alone can alter battery costs by 20–30%.

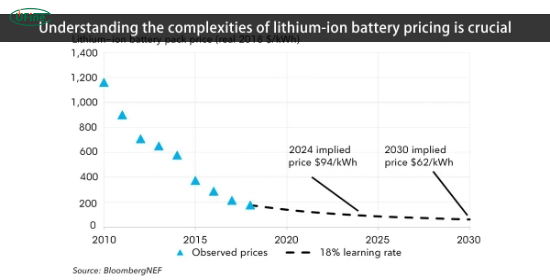

Will lithium batteries become cheaper in the next decade?

Yes. Analysts forecast $60–80/kWh by 2030 (down from $150/kWh in 2022) due to recycling, new chemistries, and scaled production.

Are lithium batteries cheaper than lead-acid batteries?

Initially, no. A lithium battery costs 3x more upfront, but its 10-year lifespan (vs. 3–4 years for lead-acid) makes it 50% cheaper long-term.

How do electric vehicles affect lithium battery pricing?

EVs drive 65% of lithium demand. While this strains supply chains, automakers’ bulk orders incentivize factories to cut costs through innovation.

Can renewable energy storage reduce lithium battery costs?

Absolutely. Utility-scale solar/wind projects require massive storage, pushing manufacturers like Fluence to develop low-cost, high-cycle batteries.

Related Tags:

More Articles

How to Choose the Best Floor Scrubber Battery for Commercial Cleaning?

Selecting the ideal floor scrubber battery ensures a long runtime, rapid charging, and minimal maintenance for efficient commercial cleaning operations.

Battery for Blower vs Battery for Leaf Vacuum: Which One Should You Choose?

Battery for blower vs leaf vacuum—learn the key differences in power, fit, and runtime to choose the right battery for your outdoor tool needs.

How to Choose the Right Battery for Blower?

Choosing the right blower battery? Consider voltage, capacity, chemistry & usage. This guide helps match the best battery for peak performance.

How to Choose the Best Insulated Battery Box for Lithium Batteries?

Choosing the Best Insulated Battery Box for Lithium Batteries? Discover key factors such as size, material, and safety for optimal protection and performance.

7 Critical Elements on a Lithium Battery Shipping Label

What must be on a lithium battery shipping label? Learn 7 key elements to ensure safety, legal compliance, and correct handling across all transport modes.