- Part 1. The decline of lithium-ion battery prices

- Part 2. The role of battery components in pricing

- Part 3. The impact of raw material prices

- Part 4. Regional differences in battery prices

- Part 5. The rise of LFP batteries

- Part 6. The future of lithium-ion battery prices

- Part 7. Conclusion

- Part 8. FAQs

Lithium-ion batteries have revolutionized how we power our devices, from smartphones and laptops to electric vehicles and energy storage systems. Over the past decade, the prices of these batteries have steadily declined, making them more accessible and affordable for a wide range of applications. In this article, we will explore the factors driving this price evolution and the implications for the future of lithium-ion battery technology.

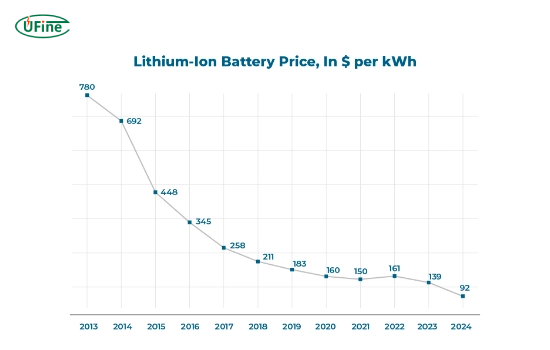

Part 1. The decline of lithium-ion battery prices

The price of lithium-ion battery cells has declined by an impressive 97% since 1991, from $7,500 per kilowatt-hour (kWh) to just $181 per kWh in 2018. Several key factors have driven this rapid price drop:

- Economies of Scale: As production volumes have increased, manufacturers have been able to take advantage of economies of scale, reducing the cost per unit.

- Technological Advancements: Ongoing research and development have led to more efficient manufacturing processes and improved battery chemistries, further driving down costs.

- Market Competition: Multiple competing battery manufacturers worldwide have created a competitive landscape that has pushed prices lower.

Part 2. The role of battery components in pricing

The cost of its various components determines the price of a lithium-ion battery. The most significant contributors to the overall cost are:

- Cathode Active Material (CAM): Accounting for 29% to 51% of the total battery cost, depending on the cell chemistry and the prices of individual metals like lithium and cobalt.

- Anode: Typically comprising 8% to 12% of the total cell cost, with graphite being the most commonly used material.

- Separator: This critical safety component makes up around 7% of the total lithium-ion battery cell price cost.

- Electrolyte: The ion transport medium accounts for approximately 4% of the cost.

As the prices of these raw materials fluctuate, battery manufacturers must adapt their pricing strategies accordingly.

Part 3. The impact of raw material prices

The prices of the raw materials used in lithium-ion batteries, such as lithium, cobalt, and nickel, significantly impact the battery’s overall cost. In 2022, turmoil in battery metal markets led to a 7% increase in the price of lithium-ion battery packs compared to 2021.

However, the prices of these critical materials have stabilized, with cobalt, graphite, and manganese prices falling below their 2015-2020 averages by the end of 2023. This has allowed battery prices to start falling again, with a 14% drop between 2023 and 2022.

Part 4. Regional differences in battery prices

Battery prices vary across regions due to production costs, local policies, and market maturity. In 2023, the average battery pack price was lowest in China at $126/kWh, while packs in the US and Europe were 11% and 20% higher, respectively.

The localization of battery manufacturing in regions like the US and Europe could exert upward pressure on prices as the local industries scale up. However, policies such as the $45/kWh production tax credit for cells and packs under the US Inflation Reduction Act could help offset some of these costs.

Part 5. The rise of LFP batteries

One of the most notable trends in the lithium-ion battery market is the increasing adoption of lithium iron phosphate (LFP) batteries. These batteries have the lowest global weighted average prices, costing cells $95/kWh in 2023.

LFP batteries are desirable due to their low cost and high safety, making them popular for applications like electric vehicles and energy storage systems. In 2023, on average, LFP cells were 32% cheaper than lithium nickel manganese cobalt oxide (NMC) cells.

Part 6. The future of lithium-ion battery prices

As the demand for lithium-ion batteries continues to grow, driven by the increasing adoption of electric vehicles and renewable energy storage, the industry must keep pace with supply. Ongoing investment in mining and refining will be crucial to ensure that global supply can meet future demand and avoid supply chain bottlenecks.

However, the industry is also exploring alternative battery chemistries and technologies that could help mitigate the demand for critical minerals. Innovative technologies like sodium-ion batteries and advanced cathode materials like silicon anodes can reduce costs and improve performance.

Part 7. Conclusion

The evolving landscape of lithium-ion battery prices has been shaped by a complex interplay of factors, from raw material costs and manufacturing processes to market competition and regional policies. As the demand for these batteries continues to grow, driven by the increasing adoption of electric vehicles and renewable energy storage, the industry must adapt and innovate to maintain a steady price decline and ensure widespread accessibility. Investing in new technologies, optimizing supply chains, and fostering a competitive market, the lithium-ion battery industry can continue revolutionizing how we power our world.

Part 8. FAQs

-

What factors influence the price of lithium-ion batteries?

Several factors, including the cost of raw materials, manufacturing processes, economies of scale, technological advancements, market competition, and regional policies, influence the price of lithium-ion batteries. -

Why have lithium-ion battery prices been declining?

Lithium-ion battery prices have declined due to factors such as economies of scale, technological advancements, and market competition. As production volumes have increased and manufacturing processes have become more efficient, the cost per unit has dropped significantly. -

How do lithium-ion battery prices vary across regions?

Battery prices vary across regions due to production costs, local policies, and market maturity. In 2023, average battery pack prices were lowest in China, while packs in the US and Europe were higher due to higher costs associated with scaling up local manufacturing. -

What is the role of raw material prices in lithium-ion battery pricing?

The prices of raw materials used in lithium-ion batteries, such as lithium, cobalt, and nickel, significantly impact the overall cost of the battery. Fluctuations in these prices can lead to changes in battery prices, as manufacturers must adapt their pricing strategies accordingly. -

What is the future outlook for lithium-ion battery prices?

The future outlook for lithium-ion battery prices is positive, with continued investment in mining, refining, and technological advancements expected to drive further cost reductions. However, the industry must balance profitability with competitive pricing to ensure a resilient and sustainable supply chain.

Related Tags:

More Articles

What are Watts and Watt Hours in Battery?

Understand watt vs watt-hour in batteries, how to calculate battery watt hours, and what Wh means for car batteries, devices, and energy storage.

A Complete Guide to the Best Batteries for Flashlights

Compare the best batteries for flashlights, including AA, AAA, 18650, 21700, CR123A. See which battery offers the best brightness, runtime, and reliability.

How Long Do Rechargeable AA Batteries Last?

How long do rechargeable AA batteries last? Compare NiMH and lithium AA lifespan, recharge cycles, key factors, and performance vs alkaline batteries.

How Much Current Can a 9V Battery Really Supply?

Discover how many amps a 9V battery can supply, its actual current output, discharge rate, and capacity for alkaline, lithium, and rechargeable 9V batteries.

12V STD vs 12V AGM: Meaning, Differences, and Which Is Better

Understand what STD and AGM batteries mean, their key differences, and which 12V battery fits your needs best in 2026.